- By Louise Binney, Corporate Sales Director UK & Europe, Worldpay from FIS®

- 23 January, 2023

Share by email

Payments play a critical role in streamlining purchases to ensure customers can pay quickly and easily, supporting businesses in optimising the cashflow into their business and optimising growth.

By Louise Binney, Corporate Sales Director UK & Europe, Worldpay from FIS®

Evaluating your existing payment processes can help you to:

- Reduce costs and drive growth

- Increase customer reach and spend

- Improve digitalisation and reconciliation efficiencies

- Understand alternative payment methods and customer demand

Increase your probability of success by creating efficiencies in your payments eco system

The last few years have seen a huge transformation in payments, resulting in businesses implementing more than one payment option for their customers.

We have seen three key themes emerging over the last year:

1) Businesses that started digitalising to survive will now continue to thrive

Over the last two years, consumers have rapidly embraced digital payments within their everyday lives. Payments have become more embedded into consumers' lifestyles, for example with the rise of shopping via social media platforms and sending payments via messaging apps.

2) Certain COVID-19 implications accelerated digital transformation, resulting in unforeseen benefits for businesses

In the UK, the global pandemic has played a lasting role in the movement of money that cannot be understated. While the permanent digitisation of payments was already gaining traction, COVID-19 has accelerated the trajectory.

Beyond contactless, merchants are now realising the benefits of real-time payments: where 15% of retail business happens digitally today, that number is projected to increase to about 50% in the next three years.

3) Payments will be central to business success going forward

Digital payments now look set to become the widely accepted payment option of choice in the UK over the course of the next decade, and those who adapt to the changes in payments now will be the ones who benefit in the long run.

3 strategies to implement for business success in 2023

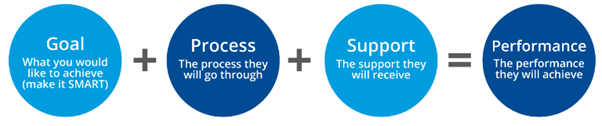

1) Create a GPS plan (Goal, Process, Support) and review it regularly

Take time to plan out exactly how you will achieve your goals with the use of a GPS plan.

A good plan includes monthly revenue projections from existing clients and new clients. It also lays out everything you need to do from marketing to hiring new employees, investing in equipment to opening new locations.

A well-thought-out plan will include every step you should take from today until December 31st 2023.

You must treat your GPS plan as a living, breathing document. Set up monthly meetings with key people on your team, as well as advisers (e.g., lawyer, accountant), to make sure you stay on track.

2) Form stronger virtual connections with your customers and prospects

Since 2020, we have seen 6 in 10 companies open new lines of business or change their products and services.

Technology adoption such as contactless and mobile payments aligned almost seamlessly with the changing buyer behaviours and demands of their customers.

Digital connectivity will be a top resource in business and virtual transactions and e-commerce will remain vital channels for all companies.

3) Pursue digital growth alongside innovative processes and reconciliation tools

We know businesses of all sizes have streamlined their business operations to be more efficient and cost effective since 2020.

Customer demand for alternative payment methods, coupled with 24/7 accessibility to buy, requires businesses to ensure they have the most efficient payment acceptance process in place.

Learn more about taking digital payments

Through my role at Worldpay from FIS®, I aim to help business owners grow their revenue, reduce their costs and improve the buying experience for consumers, simply through an improved payment experience.

I am currently offering businesses a complimentary review of their card payment needs.

Contact me at [email protected] or 07795 601176 to discuss your needs and your plans for growth in 2023.

Worldpay from FIS® is a technology payments provider supporting businesses of all sizes with their card payment needs.

By Louise Binney, Corporate Sales Director UK & Europe, Worldpay from FIS®