- By Buckinghamshire Business First

- 21 April, 2021

Share by email

The Buckinghamshire Local Skills Report will help local employers, skills providers and other key stakeholders to better understand and resolve skills and recruitment challenges within Buckinghamshire.

The Buckinghamshire Local Skills Report:

- provides an analysis of Buckinghamshire’s skills and employment needs

- identifies the priorities for public investment

- sets out an action plan to ensure individuals and employers have the skills they need for future success

It is the result of work undertaken by the Buckinghamshire Skills Advisory Panel (SAP) during 2020/21 and has been launched by Buckinghamshire Local Enterprise Partnership (Bucks LEP) and Buckinghamshire Skills Hub.

Buckinghamshire’s skills strengths

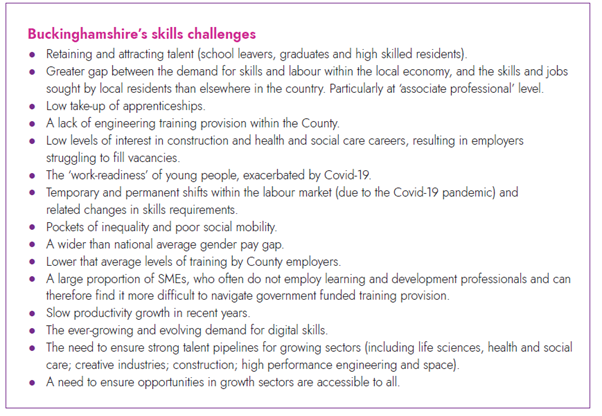

Buckinghamshire's skills challenges

Action plan: identifying priorities to focus on

Skills priorities identified for Buckinghamshire in the Local Skills Report include:

- Strengthening the talent pipeline for growth sectors and key key occupations with skills shortages.

- Improving the work-readiness of young people leaving education and entering the job market.

- Helping individuals navigate the impact of COVID-19 on the job market.

- Raising the digital skills of residents, workforces and businesses.

- Ensure young people can access the best careers information and advice, building on great work already in place by the Buckinghamshire Skills Hub (see the new Bucks Skills Hub website here).

- Providing workforce development support for SMEs, start-ups and the self-employed.

- Maximising the impact of national skills policies for Buckinghamshire residents and employers.

- Attracting and retaining talent within the county.

The Buckinghamshire Local Skills Report >

How much do you know about the Buckinghamshire economy?

Below are some key facts and figures about the local economy.

Local business landscape

- A key feature of the Buckinghamshire economy is the predominance of small businesses. 42% of the workforce work for micro firms (employing fewer than 10 people) compared to 32% nationally.

Key growth sectors

Key growth sectors (from an employment perspective) within Buckinghamshire over the next 10 years will be:

- Construction

- Creative Industries

- Life sciences, health and social care

- Space

- High performance engineering

Sector-specific figures

- There are twice as many creative industry jobs within the Buckinghamshire economy than the national average, many of which are in the film and TV sector.

- For every 10 people working in the life sciences sector in England, there are 13 people working in the sector in Buckinghamshire.

- The Silverstone Technology Cluster, a world-leading local cluster of high-tech businesses, has grown significantly in recent years. Over 4,000 companies operating in precision engineering alone are located within a one-hour radius of Silverstone.

Workforce

- Buckinghamshire’s economy is dominated by the service sector, which provides 85% of all local employee jobs.

- Pre-COVID-19, Buckinghamshire had one of the least ‘self-contained’ labour markets in England. Around a third of working residents travelled out of the county for work, whilst 28% of all those working within the Buckinghamshire economy travelled into the county from elsewhere.

- Pre-COVID-19, Buckinghamshire employers reported that 53% of vacancies were proving difficult to fill, the highest figure of all 38 LEP areas. Buckinghamshire employers were more likely than average to report difficulties filling vacancies due to applicants lacking the required skills (28% versus 25% nationally) and due to ‘not enough people interested in the role’ (25% versus 12% nationally).

- Pre-Covid-19, there were fewer apprentices in the local workforce than the national average, and fewer young people choosing apprenticeships at the ages of 16 or 18.

- The number of Buckinghamshire residents claiming unemployment-related benefits shot up following the onset of the pandemic. In January 2021, 14,855 people were claiming, 9,315 more than in March 2020.

- At the end of January 2021, 38,600 Buckinghamshire residents were on partial or full-time furlough. This equates to 15% of employees, in line with the national average.

Self-employment

- There are high levels of self-employment within Buckinghamshire, particularly within the County’s creative and construction sectors. 1 in every 7 people working in the Buckinghamshire economy is self-employed.

Graduates moving into employment

- Those graduating from Higher Education Institutions (HEIs) in Buckinghamshire are more likely to enter employment than the national average. In 2017/18, 66% entered full-time employment and 12% entered part-time employment. The corresponding figures for England being 59% and 10% respectively.

Sectors hit most by COVID-19

Sectors that have been most severely affected by the COVID-19 pandemic locally include:

- Aviation

- Live events

- Hospitality

- Travel & transport (including inbound tourism)

- Leisure & entertainment (including visitor attractions)

- Personal services (including hair and beauty)

- Arts & culture (including theatres)

- Suppliers to the above sectors

- Suppliers to the education sector